Time in a time again, people we work with keep coming back to this question, asking us “Is Bitcoin a good investment still?” We’ve been tending to this question for years now. However, if one thing has become clear to us it is that most people are still oblivious to what Bitcoin is. In fact, cryptocurrency in general, and the underlying Blockchain Technology, is still in the shadows for a majority of people.

While the purpose of this article is not to give you any investment advice on cryptocurrencies, we will, however, give you some insight into why cryptocurrencies are gaining so much traction, reasons to invest in cryptocurrency, and why Bitcoin is a good investment option, going into 2021.

Digital Currencies, DigiCash, a History

The concept of digital currencies

Although we have Bitcoin to thank for popularizing the term “cryptocurrency,” the concept of digital currencies were conceptualized as long back as the 1980s. The first known attempts at digital currencies happened in the Netherlands. Fuel stations in some of the remoter areas started witnessing a series of robberies in the middle of the night. This created a growing concern for the safety of the night-shift guards working in these fuel stations. The operators were uncomfortable putting the guards at risk.

Following these ill events, the operators started giving the truck drivers smart cards (which were being trialed at the time). These smart cards contained an amount of money as credit and the fuel stations started accepting this new digital payment method.

The fuel stations were now safe for the truck drivers and security guards at night, and voila! Electronic cash was born.

DigiCash, the Granddaddy of Bitcoin

The closest relative of Bitcoin took birth with the experiments and investigations of American cryptographer and computer scientist David Chaum. His company, DigiCash, is one of the earliest digital currency companies. He used this firm to introduce ecash in 1989, the first proper mainstream predecessor of the modern Bitcoin.

Drawbacks of Early Digital Currencies

The major drawback of early digital currencies is related to some simple economic principles, more specifically, the concept of supply and demand.

Let’s say that you launch a few thousand digital coins. You own and control these coins and what happens to them is completely up to you. People start using some of your coins for payments and trading. This will generate liquidity and give value to your coins.

Now, out of the blue, you claim that the total number of coins is not a few thousand but a few hundred. What this does is that it cuts down on the supply of the coins dramatically and the value of the coins skyrockets up. While this seems like a good thing for you and your coins, this opens doors for major manipulation of the market. This compromises trust with your users and, in turn, develops into a major threat to the economy.

This is one of the major reasons that many economists explicitly objected to the idea of digital currencies initially.

Satoshi Nakamoto, Blockchain, Bitcoin

In 2008, USA witnessed one of the most challenging economic crisis of recent times. And, of course, this affected the world economy drastically. However, it was also a major checkpoint in the timeline of the global economy, shedding the light on the rusty attitudes of the evangelists of global finance, who seemed to be a little bit callous.

Right around this time, an anonymous person or a group of people named Satoshi Nakamoto published a white paper. The white paper was a document outlining the concept, the technology, and the ways to implement a new kind of system. A public distributed ledger system called Blockchain.

Furthermore, they also introduced a new kind of digital currency, one that is cryptographically secured, and functions on this Blockchain ledger. As a result, Bitcoin was born.

Advantages of Bitcoin

The major advantage of Bitcoin over traditional digital currencies is that Bitcoin runs completely on the Blockchain. Blockchain Technology is the backbone of all cryptocurrencies we see today.

Blockchain provides superior performance over other ledger systems owing to 4 major advantages.

- 1. Security.

- 2. Transparency.

- 3. Immutability.

- 4. Decentralization.

Blockchain is a distributed ledger system with no central authority. You can think of the ledger as a database that spreads across several servers all over the world. We call these databases Blocks and they are interconnected. When new data comes in, the system creates a new block and stores it there. Each new block will have something called the cryptographic Hash of the previous block, which is basically like an encrypted text file with a password and some data input from the previous block.

If any hacker or even the person wants to change something inside an existing block, they would have to decipher this Hash. This single process alone involves solving highly complicated mathematical computations and requires a lot of computing power. Moreover, if someone tries to make any change to a block, all other blocks will be notified.

To clarify, if someone wanted to practically hack into the system, they would have to do so with each and every block in the Blockchain. And since the system distributes each block across different servers, there is no central point of weakness. A hacker would need an extreme amount of computing power to carry out this task, which is practically impossible.

We’ve been talking more about hackers but like we said, even the person who created the Blockchain can’t make any changes to it. Moreover, on a Public Blockchain, all transactions are publicly visible to all participants. As a result, Blockchain Technology emerges as the most trustworthy and transparent system there is.

Let’s get to the question of the hour “Should I invest in Bitcoin?”

The answer to this question somewhat applies to most if not all cryptocurrencies. But for the purpose of this article, we’ll talk about Bitcoin.

A total of 21 Million Bitcoins (BTC) were launched at the start of the project. In other words, there will only be 21 Million Bitcoins in existence. Nearly 18.6 Million Bitcoins have been mined until now, we guess you get the point now. Here comes the principle of Supply and Demand. When the Supply is limited and the Demand is more, the value of the currency also increases significantly.

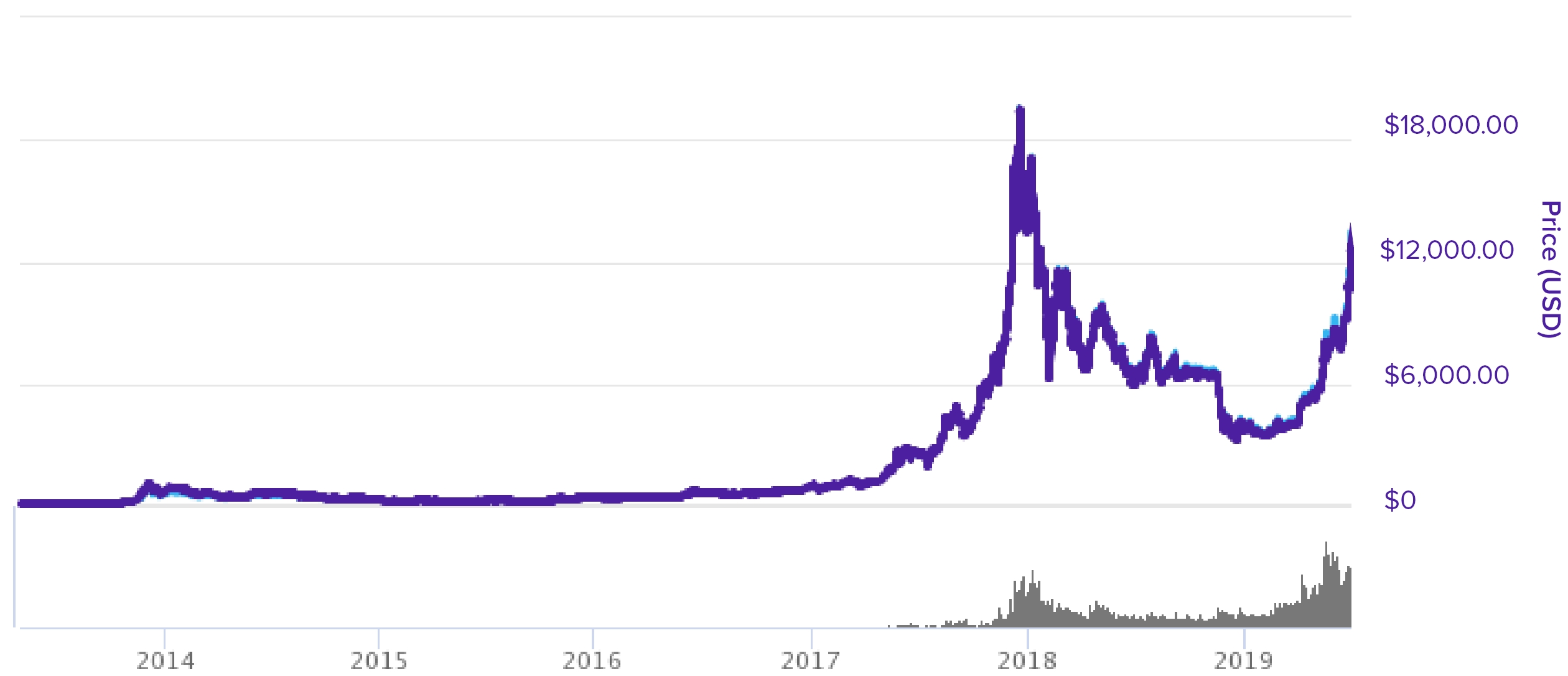

It’s no surprise that the price of Bitcoin is at an all-time high right now. Moreover, with people trading the currency more and more every day, this high liquidity-generating cryptocurrency will keep gaining value for the years to come. Additionally, when all the 21 Million Bitcoins come into circulation, the price will likely skyrocket quite dramatically.

So, is Bitcoin a good investment in 2021?

Bitcoin is a great investment and will be a great investment in 2021 and the years to come, given that the project carries on its current course. Keep in mind that the value of cryptocurrencies is highly volatile. You could make millions in a day and lose it all the next hour. It depends solely on the market at that time. However, in the long term, you could definitely profit off of this revolutionary currency if you keep a close eye on the market and act at the right time.

We hope this article helped you out, and if it did, consider sharing it with your friends. We post interesting and informative articles like this from time to time so make sure you check back often.